6 Money Hacks That Helped Me Save $10,000 in Just 4 Months as a 25-year old tradie (Without getting a second job)

As a 25-year-old electrician from Brisbane, I spent years watching my decent income disappear before my eyes. I was making good money but had absolutely nothing to show for it. Every payday I'd promise myself I'd save, but somehow the money just vanished by the next payday.

I'm not special – I didn't win the lottery or suddenly start earning double. I just discovered six unconventional money hacks that completely changed my relationship with money and helped me save $10,000 in just four months.

1. The "Physical Cash Commitment" Strategy

My biggest breakthrough came when I realized digital banking was actually making it harder for me to save, not easier.

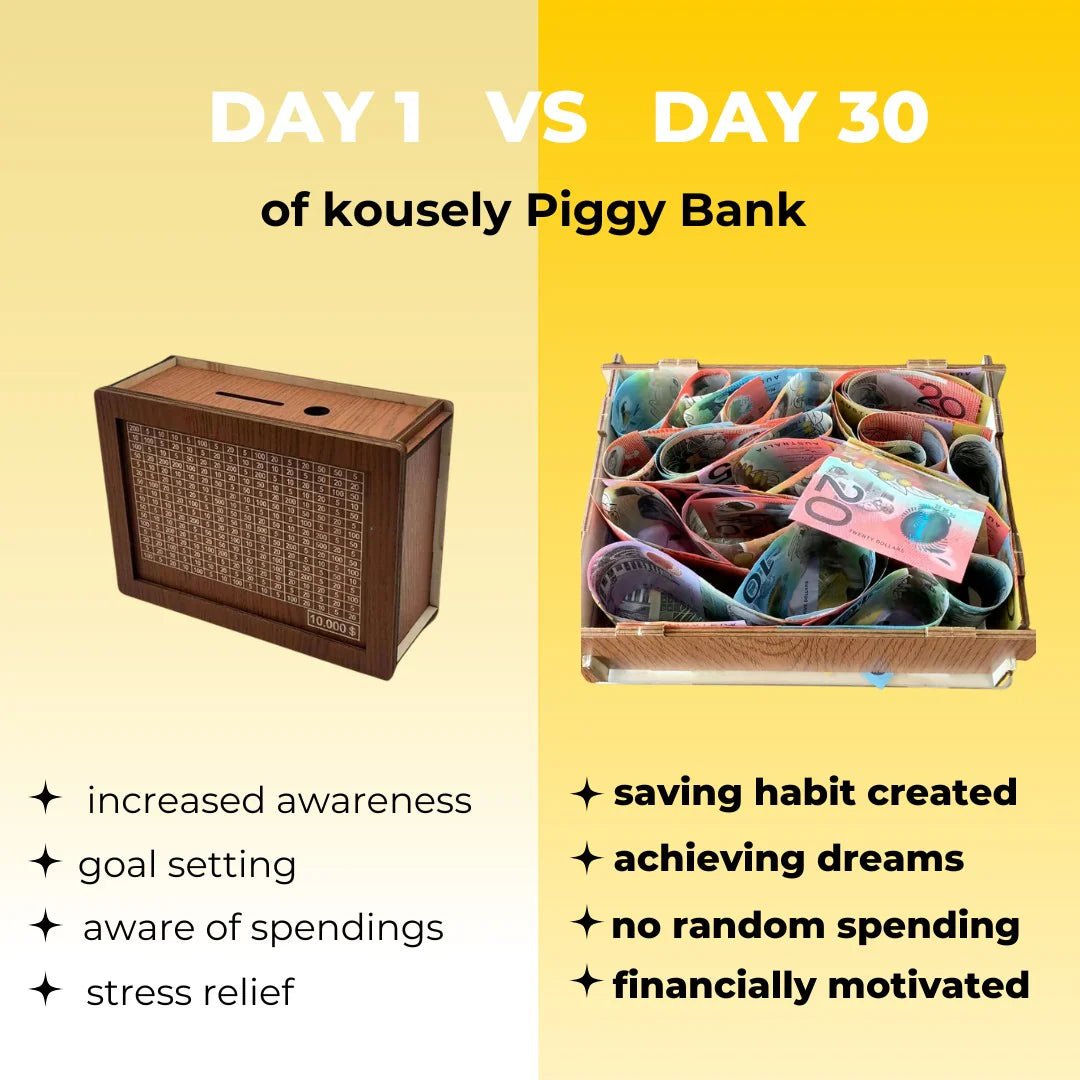

Tapping my card made spending feel like a game, not something real. When I switched to the kousely Japanese Method Piggy Bank with its physical tracking system, everything changed for me.

The system uses what behavioral economists call "tangible interaction" – I physically handle cash and cross off saved amounts, creating a psychological commitment that my digital transfers never did.

I later found out that research from the University of Toronto confirms this works: people who regularly interact with physical money save an average of 15-23% more than those using exclusively digital methods. Looking back, this makes perfect sense to me now.

That's why Australian household savings are at an all-time LOW!

Money box creates a psychological hack for saving that digital methods can't replicate.

2. The "Cross-Off Dopamine" Technique

Unlike saving apps that I'd always ignore after a few weeks, I discovered that physically crossing off savings goals triggered a powerful psychological reward.

Every time I deposited money and crossed off another number on my kousely piggy bank, I got this little rush of satisfaction. After a while, I actually looked forward to saving day more than spending.

This isn't just in my head – a 2019 study found that physically tracking progress toward goals improved follow-through by 42% compared to digital tracking.

The act of crossing off numbers releases dopamine – the same "reward chemical" your brain produces during achievements.

It has switched my brain chemistry up and now I get more joy from saving money than I do spending it.

3. The "Payday Ritual" Method

I developed a simple ritual that transformed my saving habits: every payday, before spending a cent, I withdraw my saving amount in cash and immediately deposit it in my kousely Piggy Bank.

The key for me was doing it first, not saving "whatever was left" at the end of the week. When I physically see that money leave my hands and go into the piggy bank, it becomes real. I've crossed it off my tracker and it's untouchable.

I've since learned this approach leverages what neuroscientists call "implementation intentions" – specific plans that state exactly when, where, and how you'll take action. Studies show they make you 2-3 times more likely to follow through.

All I know is it works for me.

4. The "Money Visibility" System

Unlike most of my tradie mates who have no idea where their money goes, I made my savings progress unmissable.

I keep my kousely Piggy Bank visible in my living room, not hidden away like a regular bank account. Every time I walk past, I can see how much closer I'm getting to my goal.

This visibility technique taps into what psychologists call "environmental cues" – physical reminders that prompt specific behaviors.

By making my savings visible, I created a constant reminder of my priorities.

5. The "Spending Pain" Principle

I discovered that digital payments had eliminated what economists call the "pain of paying" – the mild discomfort that helps regulate spending.

When I have to physically break a $50 note for a small purchase, it makes me think twice. With tap-and-go, I never felt that moment of hesitation.

By reintroducing this natural psychological barrier through the Japanese Kakeibo method, I found myself making more deliberate spending choices. The result? I discovered "extra" money I never knew I had.

I wasn't earning more, I was just spending less unconsciously. It wasn't about willpower – it was about changing the system.

6. The "Reverse Budget" Hack

Instead of tracking every dollar like traditional budgeting methods suggest, I flipped the process.

I used to hate budgeting apps – they were just another thing I'd forget about. With the kousely system, I only had to focus on two numbers: how much I saved and my total goal.

By simplifying my financial focus to just saving (not detailed tracking of spending categories), I eliminated the overwhelm that caused me to abandon previous saving attempts.

It was the first financial system that didn't make me feel stupid for not understanding it.

I just had to put money in and cross off the number. That simplicity was what made it stick for me.

The Results: $10,000 in Four Months

What shocked me most wasn't just the amount I saved, but how painless it felt.

I honestly didn't feel deprived. I was still going out with mates and living my life.

The difference was that I became more intentional about my spending and actually got satisfaction from watching my savings grow.

Imagine that feeling when you have 10K sitting in that box?

Within four months, I had saved the $10,000 I'd been trying to accumulate for years – all without working overtime or picking up side gigs.

My tradie mates kept asking if I was doing cash jobs on weekends. They couldn't believe I was saving that much from my regular income.

Now five of them have gotten the kousely Piggy Bank too.

The Science Behind the Method

My experience isn't just luck. The Japanese Kakeibo Method has been proven effective for generations and is supported by modern research in behavioral economics and psychology.

The kousely Japanese Method Piggy Bank has adapted this centuries-old approach specifically for today's Australians, combining the psychological power of physical interaction with the visual satisfaction of tracking progress.

Unlike digital banking, which relies on willpower (a limited resource that depletes throughout the day), this system creates physical rituals and visual cues that bypass willpower limitations entirely.

According to behavioral design research, visible triggers are 3-4 times more effective at maintaining habits than invisible automated systems – explaining why I succeeded where banking apps had failed me.

Want to Try What Worked For Me?

The kousely Japanese Method Piggy Bank that transformed my finances is now available across Australia, and for a limited time, they're offering 40% off plus free shipping.

Each system includes:

The kousely Japanese Method Piggy Bank

Reusable saving tracker

30-day money-back guarantee

Or simply put, you are unsatisfied for any reason whatsoever…

You'll receive a 100% refund

No questions asked

No complicated forms to fill out

So all the risk is on them.

You have nothing to lose.

It's weird to think a simple piggy bank could change everything, but it's not about the box – it's about how it changes your relationship with money.

For the first time, I feel in control instead of constantly stressed about finances.

★★★★ Trusted by 10,000+ Happy Aussies